Southeast Asian Power Market Report – Indonesia

K&A is a leading global power industry marketing agency, providing marketing consultancy services such as lead generation, digital marketing, demand generation, content creation, and more to global energy industry OEMs.

In 2012, K&A published an in-depth power industry report of Southeast Asia. Our market report covers everything from generation and transmission to grid modernization and emissions within these markets. Our reports are filled with up-to-date information and analysis that facilitate decision-making. We perform in-depth research that combines primary and secondary sources, working together to form a clear and concise overview of the market and highlight the most relevant local power industry trends. We also write specialized technical and commercial content for our energy industry clients, such as technical writing, thought leadership, and public relations articles.

Fill the form below to access our comprehensive Indonesian Power Industry Report for in-depth market insights. Our 2024 Southeast Asia Power Market Report is now available. Please contact us via email at info@krishnaninc.com to learn more.

Indonesia Power Market Overview

Indonesia has abundant natural resources suitable as power generating feedstock. This is especially the case for coal, natural gas, geothermal and hydro based energy.

Despite this relative abundance Indonesia's existing generating capacity is largely coal and oil fired and, at around 44 GW, results in a per capita MW capacity which is amongst the lowest in the region.

Indonesian growth rate of demand for electricity remains high at an estimated 9.5% per annum up to 2029

Electrification ratio is still low at 74% in 2013

Numerous islands limit the scalability of power projects

Indonesia’s Power System

Indonesia - Installed Capacity (MW)

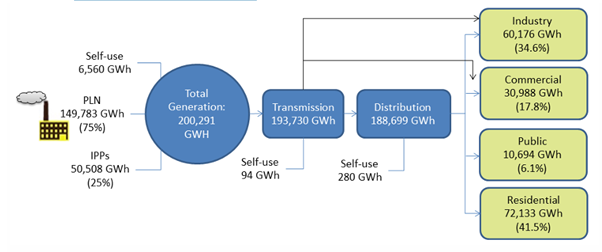

In 2012, 41.5% of Indonesia’s 200,291 GWh was consumed by households. Industry and commercial users consumed a combined 52.4%. Source: PLN

Indonesia Power Industry Challenges

Indonesia is one of the most densely inhabited countries in Southeast Asia and the fourth most populated country in the world. Maintaining an efficient nation-wide energy system is an enormous challenge for a country with such a dense population spread over a large archipelago of more than 17,000 islands. Indonesia’s energy sector has struggled to keep up with the rapid pace of economic growth. Some of the key reasons for this include:

A mismatch between primary energy resources versus population density

An estimated 80% of population is located in Java-Bali although majority sources of primary energy are in other islands

Lack of supporting infrastructure, gas pipelines and coal transportation and distribution

Dependency on oil as primary energy for electricity generation – which is expensive and limited

Limited financial budget to develop electricity sector which is plagued by a low electrification ratio

Indonesia's total primary energy consumption grew by over 50% between 2001- 2010. According to the International Monetary Fund (IMF) Indonesia’s economy has strongly emerged from global financial crises with the average growth rate of about 6% in past five years. With the total population of 248 million growing towards industrialization and urbanization, Indonesian demand for electricity is projected to rise at 7-9% annually in near-future amongst the highest in the region. In the past decade, coal consumption has tripled and surpassed natural gas as the second most consumed fuel in 2004.

Chronic underinvestment in systems improvements and new generation capacity, coupled with highly subsidized fuel and electricity rates, has left Indonesia’s power sector in a paradox. As Indonesia looks to meet the energy needs of an expanding economy, and provide energy services to currently unserved populations, it is vital that steps are taken to reduce carbon emissions without placing undue financial burdens on the sector. In 2012, Indonesia was the world's largest exporter of coal by weight and the eighth largest exporter of natural gas. Increasingly, the government seeks to reorient domestic production away from exports to meet demand at home.

Fuel Generation Options in Indonesia

| Natural Gas | Coal |

|---|---|

|

|

| Oil | Geothermal |

|

|

| Solar | Biomass |

|

|

| Hydro | Nuclear |

|

|

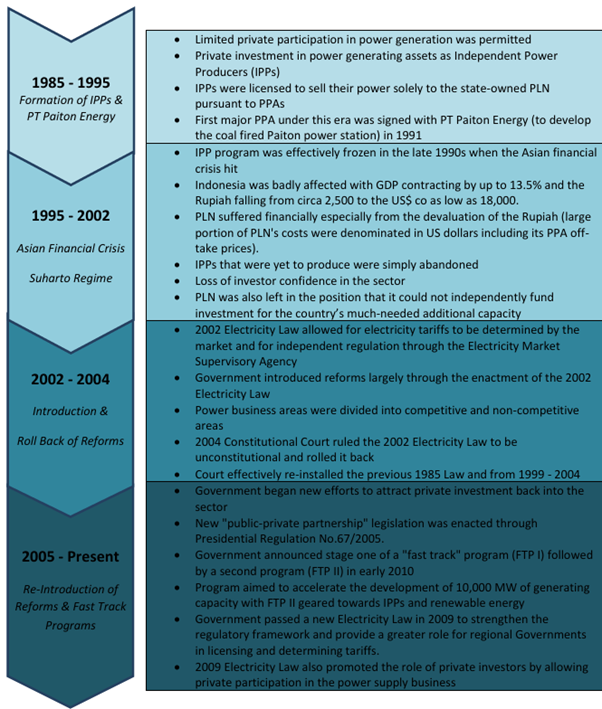

Indonesia Regulatory Policy

SWOT Analysis- Indonesia Power Market

| Strengths | Weaknesses |

|---|---|

|

|

| Opportunities | Threats |

|

|

Indonesia Power Market Forecast

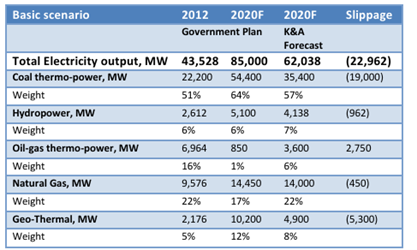

The long-term target by Indonesia is to achieve 85,000 MW by 2020. According to the base case scenario of the RUPTL Plan (2011-2020), the overall domestic power demand is forecasted to increase by 8.5% annually during this period. Therefore, within these 8 years (2013-2020), Indonesia must construct an additional ~41,000 MW to total existing capacity.

New additional coal fired capacity requirement is targeted at ~54,000 MW by 2020. New oil and gas fired capacity is targeted at 15,000 MW by 2020. As per the current plan, by 2020, coal-based generation will increase to 64% of installed capacity, natural gas will account for 17%, hydropower 6% and geo-thermal about 12%.

Krishnan & Associates projects only ~62,000 MW will be online by 2020 with an estimated slippage of 22,962 MW. An additional 13,000 MW of coal fired generation is anticipated during this period.

Indonesia’s Challenges to Achieving the Targets

Power Tariff Revision

Land Acquisition

Delay in Fast-track Programs

Attracting IPPs a Challenge

Ministry of Forestry Permitting

Exchange Rate Depreciation Impacting New Project