Asia Power Market Report - Vietnam Energy

K&A a leading energy consulting firm has developed comprehensive power market reports & focused on power generation, power transmission & distribution as well on a range of power grid modernization, emissions and decarbonization issues. Here is an executive summary of a 2012 Vietnam power generation market analysis & with a market forecast that closely mirrors 2024 market conditions.

Fill the form below to access our comprehensive Vietnam power Industry Report for in-depth market insights. Our 2024 South East Asia Power Market Report is now available. Please contact us via email at info@krishnaninc.com to learn more.

VIETNAMESE POWER INDUSTRY STRUCTURE

Over the last decade, the rapid growth and expansion of Vietnam’s economy has dramatically increased the demand for electricity in the country. Faced with this challenge, Vietnam’s power industry has struggled to expand and improve the country’s power system, as evidenced by difficulties with developing new resources, enhancing high-voltage transmission lines, and reducing transmission and distribution losses.

At present, Electricity of Vietnam (EVN), a state-owned enterprise which reports directly to the Prime Minister, is the single buyer of electricity from power plants and holds a practical monopoly on electricity transmission and distribution. The electric power industry is under the jurisdiction and management of the Ministry of Industry and Trade (MOIT).

VIETNAM POWER MARKET OVERVIEW

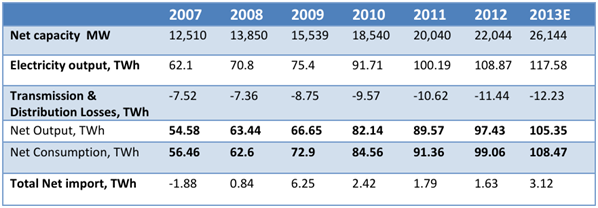

Vietnam’s installed capacity is currently just over 23,000 MW and annual power production is approximately 100,000 GWh per annum. At just over 1,000 kWh per capita, Vietnam has one of the lowest electricity consumption rates in Asia. However, with GDP growth of approximately 6% per annum the consumption of electricity is growing rapidly at a rate of approximately 12% per annum.

Source: Phu Hung Securities, 2012, Whitepapers & Technical Reports

Major Vietnamese Power Suppliers

Growth of Vietnamese Generating Capacity

Historical Capacity Additions

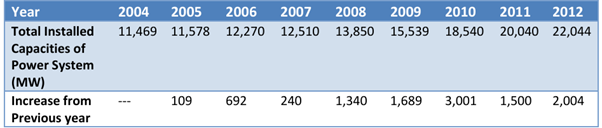

Between 2007 and 2012, the total power capacity increased by 9,500 MW. This translates into capacity additions of nearly 2,000 MW a year which falls short of the average annual target of 3,000 MW. Based on a 6.5% average GDP growth per year, the power demand is projected to increase about 4,000 MW every year between 2013 and 2015.

The construction of new power plant capacity in the Vietnam is not keeping pace with demand and this is resulting in a shortfall in power supply, especially at times of peak demand. The situation is particularly serious during the dry season, due to lower availability of the hydro-electric power plants, which make up around 40% of the country’s installed capacity. In recent years the drought resulted in reduced availability at hydro-electric power plants, which forced the state-owned Electricity of Vietnam (EVN) to instigate programs of rolling blackouts and load shedding, particularly in the major cities.

Power Market Data Vietnam

Future Scenarios of Fuels

| Strengths | Weakness |

|---|---|

|

|

| Opportunities | Threats |

|

|

POWER MARKET FORECAST

Power Development Plan

The long-term target by the Government of Vietnam is to achieve 75,000 MW by 2020. According to the base case scenario of the 7th Power Development Plan, the overall domestic power demand is forecasted to increase by 14-16% annually in 2011-2015, and by over 11.5% per year in 2016-2020. On the other hand, the growth rate of total power supply in period of 2011-2015, and 2016-2020 are at least required to reach about 14% and 10% respectively. Within these 8 years (2013-2020), as per the market intelligence Vietnam must construct an additional ~53,000 MW to total existing capacity. New additional coal fired capacity requirement is targeted at ~28,000 MW by 2020. New oil and gas fired capacity is targeted at 14,700 MW by 2020. In 2020, the first nuclear power plant with the designed productivity of 2,000 MW in Ninh Thuan will commence operation. As per the Power Development Plan, by 2030, coal-based generation will increase to 56%, hydropower and gas will drop to 15% and 13% respectively.

Challenges to Achieve Power Targets

In spite of these very aggressive plans, we believe that these targets will be difficult to accomplish for the following reasons:

50% Slippage

Scarcity of Water

Transmission Losses

Domestic Fuel Shortage

Imported Fuels Expensive

EVN Tariff Correction

Electricity Pricing

Administered Natural Gas Prices Discourage Investment

PPA Structures & Counter-guarantees

Economic Slowdown Impacting New Project Development

Capital Investments

Hydropower Risks Causing Slippage

Major Vietnamese Power Companies:

EVN Vietnam

EVN is the largest power company in Vietnam having an installed electricity generation capacity of 8,860 MW and a distribution network of 19,396 kilometers (12,052 mi)

Vinacomin

Vinacomin was created by the merger of the Vietnam Coal Corporation (Vinacoal) and Vietnam Minerals Corporation. Vinacoal was established in 1995 through the merger of all Vietnam's coal exploitation and processing companies.

Coal industry: Exploration and survey, exploitation, processing, sale of coal products at domestic market, and export-import of coal products.

Mineral-metallurgical industry: Exploration and survey, exploitation, processing, and metallurgy of solid minerals: bauxite (alumina - aluminum); iron ore (producing steel ingots), copper, lead, zinc, tin, titanium, manganese, gemstones, gold, and other minerals.

Power industry: Development, operation of power plants (mainly coal-fired thermal power).

PETROVIETNAM

PETROVIETNAM, Vietnam Oil and Gas Group is a state-owned company. On June 18th, 2010, the Prime Minister issued the Decision No. 924/QĐ-TTg accepting that PETROVIETNAM is the state-owned Company Limited-Vietnam Oil and Gas Group (short name is Vietnam Oil and Gas Group) with international transaction name Petrovietnam, PVN for short.

K&A Power Market Analysis & Estimates (Adjusted)

K&A's research provides a market assessment of Vietnam's coal mining capacity and offers market forecasts for future production. Our analysis indicates that total domestic mining capacity in Vietnam will be approximately 56 million tons by 2020. Domestic producers, primarily Vinacomin, are not expected to meet their projected target of 69.5 million tons by 2020. We anticipate a 20% deficit causing domestic coal capacity to be approximately 56 million tons. Imports are projected not to exceed 10 million tons by 2020 given the short supply of low-cost coal, transportation bottlenecks, limitations with expansion of coal handling terminals and the inability of existing PPAs to pass through fuel cost escalations. Consequently, total coal availability is expected at approximately 65 million tons by 2020. Even if all this coal is utilized, power production total generation capacity in 2020 is not expected to be more than 22 GW and 44 GW by 2030. This translates into a slippage of approximately 36% - 51%. Major fuel and tariff policy changes have to be instituted along with infrastructure improvements for Vietnam to be able to produce and/or import more coal.

Market Forecast for Coal Fired Power Generation